Spending Less When You Are Temporarily Living in Survival Mode

There are many times in life when you may feel like you are in financial survival mode.

The economy may be in a recession, inflation is high, or you may face job loss.

At times like this you need to think quickly about what you can do to tighten up your budget, and fast.

Hopefully you are already running a pretty tight ship at all times but during a time like this you may need to go to extremes to make ends meet.

Steps you can take to tighten up your budget:

1. Assess the Situation

- Calculate your available cash: Include bank balances, emergency funds, and expected income.

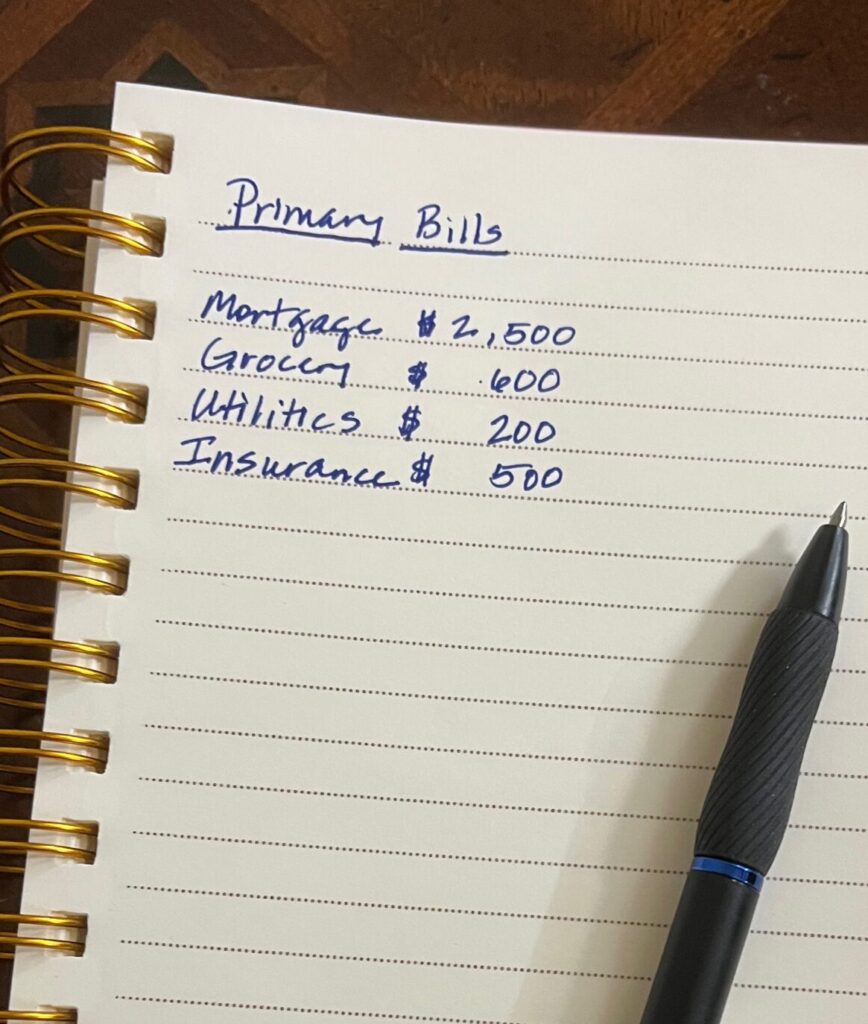

- List all expenses: Separate essentials from non-essentials.

2. Prioritize Essential Expenses

Focus on:

- Housing (rent/mortgage)

- Utilities (electricity, water, internet)

- Groceries

- Transportation

- Insurance (health, auto)

- Minimum debt payments

3. Cut or Eliminate Non-Essential Spending

Immediately reduce or pause:

- Dining out and takeout

- Subscriptions (streaming services, apps)

- Entertainment and hobbies

- Shopping for clothes, gadgets, etc.

4. Pause or Renegotiate Payments

- Call creditors: Ask for deferments, reduced payments, or hardship plans.

- Negotiate bills: Contact service providers for discounts or assistance programs.

5. Cancel or Delay Major Purchases

- Put off big ticket items unless absolutely necessary.

- Reevaluate planned spending and defer anything that is not critical.

6. Increase Income If Possible

- Sell unused items.

- Take on side gigs or freelance work.

- Look for assistance programs, unemployment, or local aid.

7. Use Savings Wisely

- Use emergency funds, but prioritize using this money for essentials.

- Avoid withdrawing from retirement accounts unless it’s a last resort.

8. Track Every Single Dollar

- Use a budgeting app or spreadsheet.

- Review daily to ensure you’re staying on track.